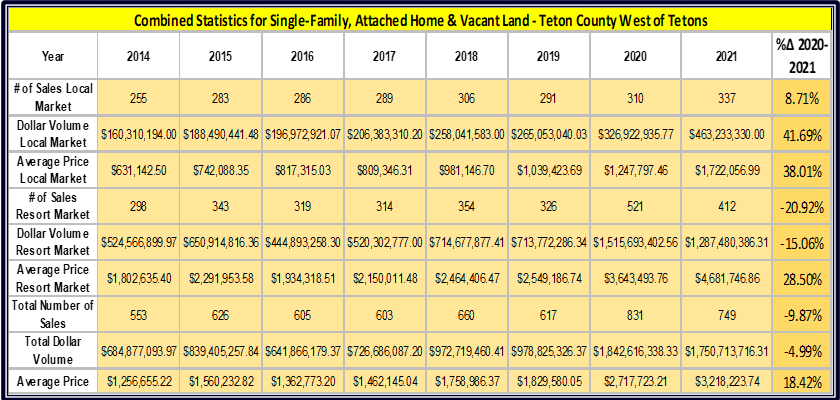

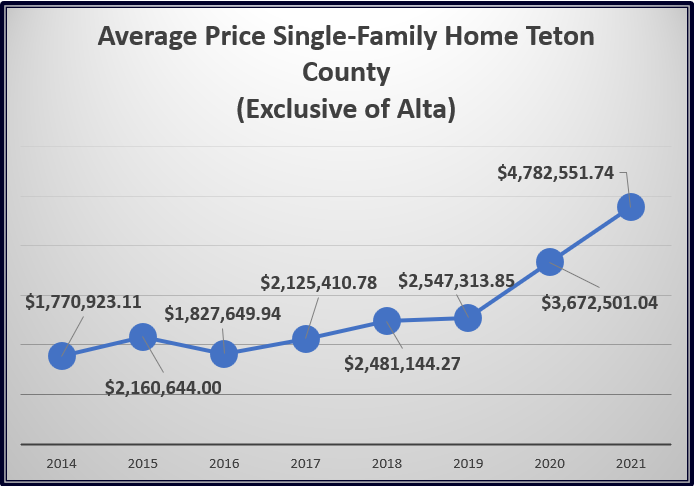

When viewing data through yearend 2021 (a composite of single-family homes, attached homes, and single-family homesites), the Teton County Real Estate Market set records in all pricing-related categories, while showing decreasing numbers of sales, the likely result of a lack of listed inventory. The result of this is total residential volume of sales that approached $1.9B (and crested the $2.0B mark when including commercial sales). A flight from more populated areas is widely acknowledged for this growth in volume in Teton County sales, with the higher echelons of the market ($5M and up) showing the largest gains – a likely result of the luxury home demographic being comprised of people having the most flexibility to move from their primary residences. The result of the competition for Teton County real estate is that inventory of available product dwindled to all-time lows with only 52 homes being available for purchase in Teton County at the start of 2022. In reaction to this, the average price of single-family homes increased 30% to a tabulated $4.78M. Admittedly, this average is heavily influenced by the prevalence of luxury single-family homes in 2021, and a discussion of market trends allocated between vacant land, attached homes, and single-family homes will follow that addresses these categories in the context of the pricing cohorts of Resort/Luxury Market as compared to what has historically been referred to as the “Local” market. The latter of these categories being properties that historically have been targeted for purchase by market participants whose economic resources were dependent on income earned locally. The premise of a local market has been called into question, with the argument existing that the increasing prevalence of remote working makes almost every home (excluding deed-restricted properties) a target for purchase by someone whose economic resources are not tied to the local economy.

Single-Family Home Sales Trends

Single-family homes increased over 30% in average price between 2020 and 2021, with the total number of sales decreasing by nearly 14%. This resulted in a reported dollar volume of sales increasing only modestly, with this metric showing growth of 3.05%. Continuing to the speaking point of the influence of the luxury/resort market, 2021 reported 84 homes selling at or above the $5M mark, while less than 70 homes sold in this range in 2020 and 30 homes sold in this price range in 2019 (total reflected properties in Teton County excluding Alta). The luxury market’s influence on increasing averages perhaps cannot be stated any more clearly then noting the sale of “Camp Teton,” a home overlooking the Snake River towards the Teton Range that was reported to have closed for $65,000,000 in late 2021. A market that has experienced the gains that have been noted in Teton County can beg the question of a price stabilization or correction on the horizon. At present, the limited inventory of homes for sale is largely attributed to there being no definitive signs of a market pause. Declining number of sales are noted as a whole, but this is again attributed to a lack of product to sell. As of early January 2022, the MLS system reported that the average price of a single-family home for Teton County was $7M.

Other Interesting Facts of Note for Teton County Single-Family Home Market:

- The average price of a single-family homes increased by 30%, while the number of sales decreased by 14%.

- 2021 reported 84 homes selling at or above the $5M mark, while less than 70 homes sold in this range in 2020 and 30 homes sold in this price range in 2019 (total reflected properties in Teton County excluding Alta).

- Teton County’s luxury home market accounted for 12.3% of the home sales volume by number, while accounting for 40% of the $1.9B worth of sales that was tallied by dollar volume.

- Melody Ranch, the south-of-town neighborhood that was platted in 1995 as a family-oriented subdivision for locals began selling lots in the $70,000 range at that time. 2021 saw one of these lots sell for nearly $1.2M and five homes sell for more than $2M, with one of these homes clearing the $3M mark.

A new home with “Mountain Modern” stylings in East Jackson sold for $1,350,000 more than it was acquired for five months earlier, equating to an annualized growth rate of 97%.

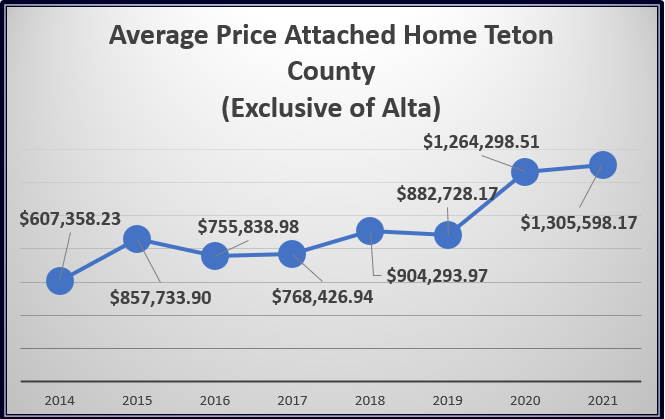

Attached Home Sales Trends

The attached home market (condominium / townhouse) remained level in the number of sales occurring, with a decrease in the number of resort attached home sales being offset by an increase in the number of local market attached homes. However, both numbers were likely governed by a lack of available inventory, a hypothesis supported by the fact that both market segments saw increases in their average prices and the total dollar volume of attached home sales increased by over 11%. The aggregated data of both of these market segments saw a moderation in appreciation rates with the local market increasing in price by 13.84% and the resort market increasing by 5.18%. This moderation of rates, however, was due to the changing composition of properties in the aggregated data, and not a lessening of appreciation rates . When viewing properties on an individual basis, price growth was noted such as 2-bedroom units in the Jackson Hole Racquet Club (“The Aspens”) that were selling the $600k range in late 2020 increasing to over $1M in 2021. Similarly, Elk Run Townhomes (once entry-level housing in the Town of Jackson) were selling for $640k in 2020 and two sales were posted for over $1.2M in 2021.

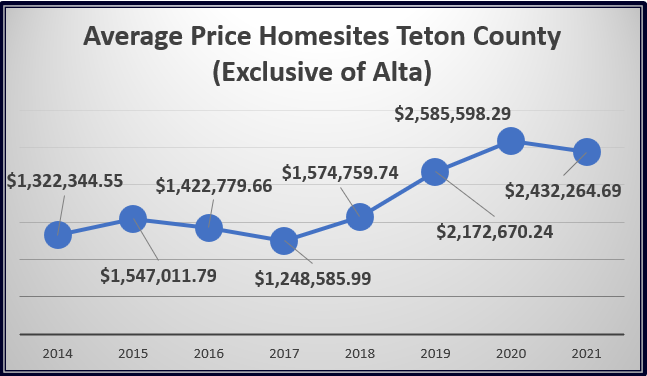

Vacant Land Sales Trends

Focusing on single-family homesites (and not ranches), vacant land sales decreased by approximately 15% in 2021, with a reasonable hypothesis being that this decrease was due to a lack of available inventory. It was noted that the average price of homesite sales decreased as well, but this is attributed to 2021 benefiting from a then-available inventory of large parcels fronting the Snake River as well as available lots in Riva Ridge, Shooting Star, and Vogel Hill (all of which were either not available or available in lesser quantity during 2021). As with the detached and attached home markets, the examination of individual sales tells the more accurate story of appreciation. With lots in Snow King Estates (once a more affordable option for an in-town location for those willing to build on a steeper slope) climbing above $1M, and previously noted sales in the third quarter of 2020 being noted in the $500k-$700k range. Notable milestones include 50 ft x 150 ft lots in the sought-after Gill Addition (benefitting from proximity to both Town and the National Elk Refuge) approaching $2M per lot for sales prices and lots in Solitude Subdivision doubling in value from $1M in November of 2020 to $2M by the end of 2021.

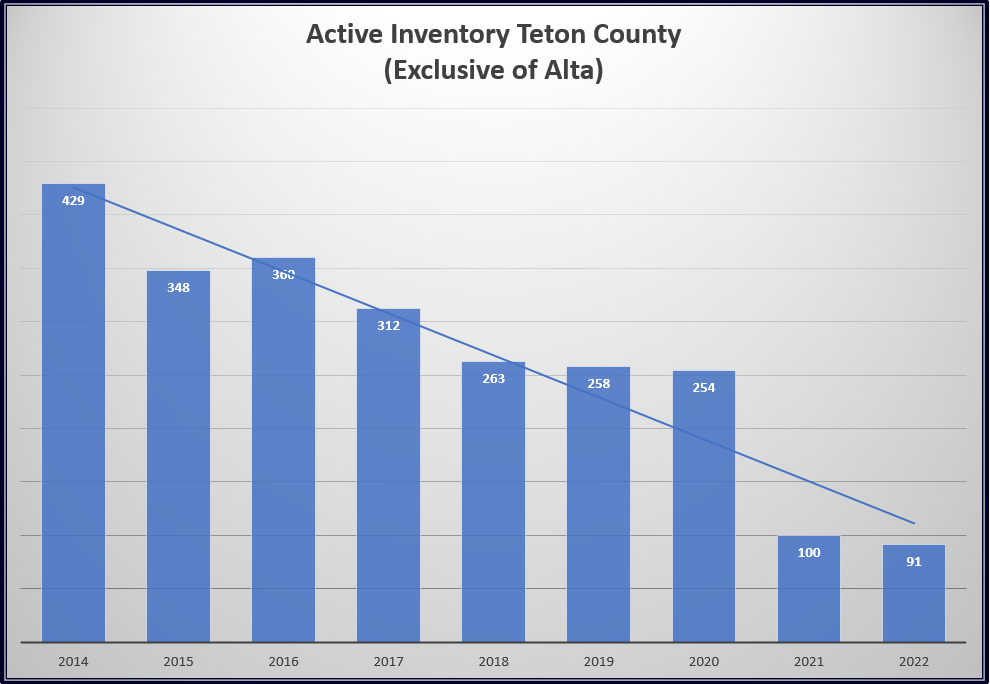

The preceding table arrays a yearend snapshot of inventory levels for the past nine years. Inventory levels continue to remain low and are frequently cited by agents as a stagnating factor for sales volume levels. Inventory shortages did not abate during 2021, with the above table showing a 9% decrease in available inventory from 2021.

Value Trends Past and Future

The result of dwindling inventory in the Jackson / Teton County Marketplace and a national migration trend towards more rural locations (with Teton County, WY arguably offering the best combination of secluded, yet amenitized mountain living) is not surprising. Teton County real estate has reported double digit annual inflation rates for the past four years. The intuition that some market segments will plateau is logical, but there is no remotely definitive evidence of this occurring at the present time. Datapoints such as the sale of a $65,000,000 single-family residence or the fact that the average listing price of a single-family home in Teton County hovered around $7M in early 2022, point to the fact that the upper echelons of the Teton County Marketplace are likely to be the most resilient in maintaining and, and adding to, their newfound value. Properties in this realm are typically there because of attributes that will always be in short supply such as elevated views, water frontage, or immediate proximity to a resort setting. It is similarly logical to assume that a property which has benefited in price growth simply by relative comparison to the upper echelon of the market but does not itself have any such uniqueness may be subject to more price variability in the future. The reliance on real estate professionalism such as that offered by the Cornish | Lamppa team to help you in this differentiation is perhaps the best investment you can make while considering an investment in Teton County Real Estate.

Andrew Cornish | Associate Broker

Jackson Hole Sotheby’s International Realty

Cornish | Lamppa Realty Group

Jackson, WY 83001

c 307.413.7799